Medical Economics in Cardiovascular Medicine

Daniel B. Mark

Overview

During the late 1960s and 1970s (euphemistically termed the “open checkbook era” in health care), hospitals and physicians in the United States were paid essentially what they charged. Competition on price was nonexistent, but competition among hospitals to have the most modern, technologically up-to-date facilities was fierce. The resulting double-digit annual escalation in health care costs alarmed both policy makers and private businesses and led to the first concerted efforts to control the growth of medical spending (1).

The failure of modest efforts at medical cost control in the United States during the 1970s and 1980s convinced many payers that the medical establishment would not voluntarily become fiscally accountable. In the late 1980s, the business and insurance communities began an aggressive bid for control of health care costs and increased accountability in medicine that led to the “managed care era.” The medical profession was caught largely by surprise (2). Many physicians had assumed that the value of the U.S. health care system was self-evident, and hence their dominant role in it was assured. Others believed that pathophysiologic reasoning or personal experience and judgment were sufficient to justify a course of action, regardless of the cost. Still others regarded any discussion of costs as demeaning to the profession. These attitudes largely became untenable when multiple outcome studies in the 1980s demonstrated that physicians practicing in different areas of the country made remarkably different management decisions for similar patients (3,4). Other studies from this period reported that physicians across the country performed significant numbers of unnecessary surgical procedures, particularly coronary artery bypass graft (CABG) surgery. Together, variability of practice and appropriateness of care studies suggested the presence of substantial waste in the medical care system and demonstrated that physicians and hospitals by themselves had no incentives to develop more standardized and efficient modes of practice.

For a brief period in the 1990s, managed care became the de facto national health care reform policy in the United States. However, by 2000, it was evident that managed care would not be an effective long-term solution to control medical spending. Further, because it was driven by market interests rather than carefully crafted policy, it did not address many key issues (e.g., access to care and funding of medical research and education).

Spending on health care has grown almost without any respite over the last 50 years in the United States, and by 2014, it is expected to reach $3.6 trillion, or 18.7% of the gross domestic product (5). Although no absolute correct level of health care spending by a country can be identified, more money to health care means less for other societal priorities. Further, the major sources for the funds are taxpayers and employers, and neither group has an incentive to spend more subsidizing health care. Consequently, the pressure from payers to resist increases will continue to intensify, and more of the expense will be shifted back to the patient/employee. In order for clinicians to be responsible stewards of medical resources and effective advocates for the true value of medical care, they must understand both the outcomes of medical care and its costs (6). The purpose of this chapter is to provide a general introduction to the key concepts of medical cost analysis and an overview of the economic consequences of selected cardiovascular diagnostic and therapeutic technologies.

Cost Terminology Glossary

Direct costs

Costs that can be unambiguously linked to the production of a given product or service. These costs are usually under the control of the health care provider.

Fixed costs

Costs that remain unchanged as production of health care services (e.g., tests, therapies) is increased or decreased. Note that costs are fixed relative to a defined time period. In the long run, virtually all costs become variable.

Incremental costs

The extra costs of shifting a group of patients from one diagnostic or therapeutic strategy to an alternative. Incremental costs are a fundamental component of cost-effectiveness analysis.

Indirect costs

Indirect costs (economics)

Economists sometimes use this term to refer to the societal costs associated with loss of productivity as a result of morbidity.

Induced costs and induced savings

The costs of tests or therapies added or averted, respectively, as a consequence of some initial management decision.

Productivity costs

A recently proposed substitute for the economic meaning of indirect costs.

Variable costs

Costs that change with each unit charge in service volume (e.g., tests, therapies).

Concepts and Methodology

Medical Economics: Major Concepts

To the average person, “cost” means money. The accountant has a more detailed notion of the resources required to produce the good or service underlying any given monetary payment (7,8). The economist, however, operates from a more theoretic position (9,10). A major economic axiom is that any societal decision to use resources in the production of goods or services is accompanied by forgone opportunities to do something else with those resources (11,12). Because each health service or program uses up some societal resources that could have been employed for some other purpose, it thereby involves a cost. Economists refer to this as “opportunity cost.” When economists talk about cost, they usually have opportunity cost rather than dollars in mind.

Economics also holds as axiomatic that society’s resources are finite. Hence, choices must be made among the competing goals that society has for its resources, and not all goals can be fulfilled (11,12). Economics provides a set of tools to help define alternatives and make choices. In this context, the health economist is concerned with answering three basic questions:

How much should be spent on health care, and what health care goods and services should be produced?

How shall these goods and services be produced?

Resources are typically divided into large generic categories, such as labor, land, and capital (e.g., machines, factories, stores of materials). The application of technology allows society to convert these raw resource inputs into desired goods and services, such as medical care. To compare societal choices for potential alternative uses of resources, it is necessary to assess the opportunity cost of health care, national defense, public education, and other societal priorities using some common metric. Some societies use barter, the transformation of one good into another of equivalent value through physical exchange, to match goods and services to individual needs. In industrialized societies, however, markets are used to match buyers and sellers, and money is employed as the exchange intermediary. The market price in these societies then represents the amount of money equivalent in value to the total resource inputs used in the production of each good or service. (Market prices also include a profit component that ideally is equivalent to a fair rate of return on investment.) The key concept to the economist is consumption of resources. The dollar cost is merely a convenient way of valuing all the disparate resources involved on a common scale.

The major concepts in a field are usually reflected in the use of specialized terminology. The earlier glossary is provided to define some of the more important terms used in medical cost analysis.

TABLE 42.1 Methodologic Issues in Medical Cost Studies | |||||

|---|---|---|---|---|---|

|

Methodology of Medical Cost Studies

The performance of a medical cost study requires that consideration be given to five issues (Table 42.1): (a) the structural framework for the cost analysis, (b) the perspective(s) of the analysis, (c) the approach to cost measurement, (d) the importance of time and the need for discounting costs in the analysis, and (e) issues related to generalizability of the findings.

Structural Framework

Cost studies generally fall into three major domains, based on the source of the data used in the analysis: observational studies, randomized controlled trials, and decision model-based studies. Observational cost studies include both descriptive series (which are sometimes referred to as cost finding or cost identification studies) and more complex analyses using regression models in nonrandomized comparisons. Descriptive cost series are primarily useful in areas where there are still few published data on costs. More complex observational studies are used to identify the major determinants of a particular treatment cost (cost drivers) or to make comparisons among providers or strategies for a particular condition. To identify the independent cost drivers in a data set, statistical multivariable models are used. In scorecarding or benchmarking applications, appropriate use of statistical adjustment techniques is critical to “level the playing field.” Understanding the major cost drivers allows the analyst to account for the factors most important to creating a level playing field.

Since the early 1990s, increasing numbers of randomized trials have incorporated cost measurement into their design (13,14). Cost data are collected in a randomized trial primarily to answer the following question: “If the intervention under study is found to be effective, as hypothesized, is it also an efficient method of improving health benefits?” Because effectiveness is almost always the primary issue for the trial, cost

is typically evaluated as a secondary end point or in an ancillary study. Whenever possible, the economic portion of the trial should be planned and conducted prospectively along with the clinical portion of the trial (15). This ensures that early consideration is given to inclusion of the most important economic variables on the case report form and that additional economic data required can be collected efficiently. Because follow-up on most trials is shorter than desired from an economic impact perspective, modeling is necessary to extrapolate within trial results to the necessary long-term perspective.

is typically evaluated as a secondary end point or in an ancillary study. Whenever possible, the economic portion of the trial should be planned and conducted prospectively along with the clinical portion of the trial (15). This ensures that early consideration is given to inclusion of the most important economic variables on the case report form and that additional economic data required can be collected efficiently. Because follow-up on most trials is shorter than desired from an economic impact perspective, modeling is necessary to extrapolate within trial results to the necessary long-term perspective.

Not all randomized trials are suitable for economic analysis. The sample size requirements to obtain a precise estimate of the difference in costs between two treatment strategies may be surprisingly large. Even in a large clinical trial, economic analysis may be problematic if the clinical protocol specifies important additional testing or treatment that distorts standard patterns of care. Generally, the best trials for economic analysis are the large, simple randomized trials that attempt to mimic as closely as possible good clinical practice as it occurs in the medical community at large (16).

An intention-to-treat analysis in a randomized trial protects from unaccounted for treatment selection biases but not other types of potential biases. Some economic analysts have been critical of the use of economic analysis in randomized trials because these analyses do not provide a picture of the economic effects of the new therapy as it will be employed in the community at large. The providers and institutions in a trial are rarely representative of the medical communities in which they practice. Trial investigators may systematically steer certain eligible patients away from enrollment in the trial because these investigators feel certain that they already know what is best for these patients. Demographic and educational factors have been shown to affect patient willingness to be randomized in a trial. Whereas these biases may affect the generalizability of the economic substudy of a randomized trial, they also affect the generalizability of clinical results of that trial (17). These issues are discussed further in the section on generalizability later in the chapter.

The third major structural option for economic analysis is a decision model in which the analyst specifies the structure of the problem and then derives the data needed to populate the model from relevant and available sources. In the empiric options discussed earlier, the level of detail of the analysis is determined through the decisions about what to measure. In the model-based approach, the analyst determines the structure of the model and therefore the level of detail considered. This, in turn, is determined by the level of understanding of the problem being studied and the detail level of the data available for the model. Patient-level data are infrequently used in such models, but meta-analyses are being used with increasing frequency to characterize clinical outcomes.

Perspectives of Cost Analysis

A cost analysis always entails a perspective that is defined by identifying the buyers and sellers (or consumers or producers) of the medical care in question (11). Table 42.1 lists the most common perspectives used for cost studies. The importance of perspective (also referred to by some as the viewpoint for the analysis) is pragmatic: a particular medical care, good, or service may be a cost from one perspective but not from another. Most health economists and health policy analysts recommend the primary use of the societal perspective, supplemented by other perspectives of interest (11).

Resource Use and Cost Measurement

After the structure and objectives of the study have been defined and the perspectives have been agreed on, decisions must be made about what resources to include in the analysis and the method to be used for assigning costs to those resources. As mentioned at the outset of this chapter, “cost” means different things to different analysts and consumers of cost data. To measure cost, one must have a clear operational definition of what is to be measured. The economist’s concept of opportunity cost represents the purest definition of “true cost.” However, opportunity cost is a theoretic construct that does not have a practical measurement analog.

Accountants are more concerned with measurement than economists and consequently make some important simplifications. To measure true accounting costs requires us to determine all the individual resources consumed in the production of a particular medical good or service and assign market prices to each. Although measurement of true accounting costs is possible in some restricted situations, most cost analyses incorporate certain approximations to increase ease of measurement. Because collecting cost information itself has a cost, the analyst must decide how much detail is necessary to satisfy a particular cost accounting goal.

Two general approaches can be used to assess the cost of medical care services and products: “bottom-up” and “top-down” (Table 42.2) (1). They differ in the level of detail used to describe resource consumption and in the quality of the cost weights collected. The bottom-up methods all involve enumeration of individual resources consumed in an episode of medical care and the corresponding cost weights. The gold standard bottom-up approach (also known as microcosting) involves a detailed assessment of all the resources consumed by the medical care in question, detailed cost accounting estimates of individual resource cost weights, and assignment of appropriate cost weights to each resource (7). The sum of the resources multiplied by their unit cost yields the total cost. Unfortunately, this method can be quite laborious and expensive to employ and is therefore infrequently used.

A simplified version of the bottom-up approach involves enumeration and costing of “big ticket items.” This method requires the identification of the subset of resources consumed that are considered the most important cost components (“the big tickets”). Use of this approach allows the analyst to concentrate on costing out only a subset of the entire resources consumed. The principal advantage of this approach is that it is less expensive. However, this approach also has several important potential limitations (Table 42.2).

The other major approach to cost estimation, particularly for hospital-based costs, is the top-down approach. At least two variants of this approach can be employed, one based on detailed hospital billing data and the other on summary episode-of-care descriptors. The method employing hospital billing records is suitable for use only in U.S. institutions that generate hospital bills (and, of course, analyses that involve hospitalizations). The medical charges that appear on U.S. hospital bills represent a tremendously inflated statement of the underlying true costs for the care in question (18). In the earlier (preprospective payment) era of Medicare, hospitals were reimbursed on the basis of their “reasonable and necessary” costs of providing care to patients. To define what proportion of hospital charges these reasonable costs were, Medicare developed an elaborate reporting system that required each hospital to file a cost report each year with the Centers for Medicare and Medicaid Services (CMS). This report provides a set of correction factors, known as the Medicare ratios of cost to charges (RCCs). The RCCs are used with a CMS-defined summary billing form, the Uniform Billing Form of 1992 (UB-92), to generate an estimate of hospital costs from hospital charge data for any hospital admission at an institution participating in the Medicare program. The major U.S. hospitals that do not generate the data necessary for these calculations include the Veterans Administration System, some other military hospitals, and some fully capitated HMOs. The strengths of this

approach are severalfold (Table 42.2) (19). Most importantly, the approach is based on a detailed enumeration of resource consumption and thus tends to provide a sensitive measure of variations in resource use. In addition, this method is suitable for use in large-scale multicenter studies involving U.S. hospitals. The top-down charge-to-cost conversion also has several limitations that should be kept in mind (Table 42.2) (20).

approach are severalfold (Table 42.2) (19). Most importantly, the approach is based on a detailed enumeration of resource consumption and thus tends to provide a sensitive measure of variations in resource use. In addition, this method is suitable for use in large-scale multicenter studies involving U.S. hospitals. The top-down charge-to-cost conversion also has several limitations that should be kept in mind (Table 42.2) (20).

TABLE 42.2 Strengths and Limitations of Cost Measurement Methods | |||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| |||||||||||||||||||||||||||

Medicare diagnosis-related group (DRG) reimbursement rates provide an alternative top-down cost estimation method that does not depend on conversion of hospital charge data (1). Once the patient’s DRG is defined, it becomes a straightforward matter to assign the “hospital costs.” This method is not sensitive to variations in resource use intensity within a given type of hospitalization. Furthermore, the reimbursement rates that are set by CMS or that are provided by private insurers are only very loosely related to the resource costs of providing care. For these reasons, DRG reimbursement rates are primarily used for economic analyses done from the CMS or other payer’s perspective. They are used for other cost analyses only when more accurate and appropriate cost weights cannot be obtained or the accuracy of such estimates is not particularly important to the overall analysis. Analogous DRG-based methods are available for use in some European countries.

Assignment of costs to physician services is typically done in one of three ways (1). In the past, physician fees (charges) were used. These numbers are determined by what the physician was historically able to bill for his or her services in the fee-for-service sector, rather than the true cost of the resource inputs. Thus, physician fees are a distorted and inflated measure of physician service costs analogous to hospital charges. However, unlike the situation with hospital charges, no Medicare conversion factors have been established to translate these numbers into true physician costs. Alternatively, physician services can be included in a bottom-up microcosting analysis (discussed earlier), although assigning costs remains problematic with this approach.

For this reason, most analysts now use the Medicare Fee Schedule, which is based in part on a resource-based relative value scale (RBRVS) developed by Hsiao and colleagues at Harvard University in Cambridge, Massachusetts (21). The underlying concept of the RBRVS is that the price of a physician service should reflect the long-term cost of providing that service. Thus, the resulting physician fees include both the variable costs of the service in question and a component of fixed costs reflecting practice overhead expenses (e.g., office staff and malpractice insurance). Medicare fees under this system are tied to the physician’s Current Procedural Terminology (CPT) classification system. Thus, use of the system in a cost analysis starts with assignment of appropriate CPT codes to the relevant physician procedures and services. The detail with which a physician’s work is recorded in a particular study determines whether this approach is more a microcosting estimation or a big ticket estimation method.

For cost analyses outside the United States, a variety of estimates of physician service cost may be available. In Canada, for example, the Provincial Health Authorities each generate their own Physician Fee Schedule that is similar in general outlines to the Medicare Fee Schedule.

Time Effects on Cost

Time has an important influence on medical costs that must be considered in economic studies. When medical care or its consequences take place over a period of years, there is broad agreement in the economic community that all future costs (as well as future health outcomes) should be expressed in terms of their “present value” to the decision maker (11). The mathematic procedure for calculating present value costs from a

stream of costs that occur over a period of years is called discounting. The rationale for discounting costs can be easily illustrated. Given the choice between having $100 now and $100 5 years from now, the decision maker will always choose the former option. This reflects the decision maker’s time preference for present value relative to future value. The time preference is logical because if the decision maker has the $100 now, he or she can invest it and have significantly more than $100 5 years from now. Conversely, receiving $100 5 years from now would be equivalent to receiving a sum less than $100 today.

stream of costs that occur over a period of years is called discounting. The rationale for discounting costs can be easily illustrated. Given the choice between having $100 now and $100 5 years from now, the decision maker will always choose the former option. This reflects the decision maker’s time preference for present value relative to future value. The time preference is logical because if the decision maker has the $100 now, he or she can invest it and have significantly more than $100 5 years from now. Conversely, receiving $100 5 years from now would be equivalent to receiving a sum less than $100 today.

Inflation is a separate issue from discounting (11). Inflation causes the value of money to diminish over time. As a simplifying step, most medical economists tend to ignore the effects of inflation. The implicit assumption is that inflation affects all components of the costs being studied or compared equivalently. However, inflation must be taken into account when comparing the results of (historical) cost studies from different years. For example, a study done in 1985 on the cost of CABG surgery would need to be adjusted for inflation to provide properly calibrated cost estimates relevant to 2006. The most common method for achieving this kind of inflation correction is through the use of the medical care component of the Consumer Price Index (CPI) or a relevant subcomponent.

Generalizability

The methodology we have reviewed so far relates to the assessment of the costs of medical care for a defined cohort of patients in the context of an observational study or a randomized trial. In either case, it is possible to collect empiric resource use and cost data on the patients in question and to draw conclusions about the economic effects of the given medical care from the empiric data available. Sometimes, however, the economic analyst is interested in a broader question: What is the economic impact of the therapy in question on an entire health system? The system in question may be a country, a state or province, a managed health care organization, or a chain of hospitals. There are clear trade-offs in moving from the empiric arena to the health system or policy arena. In particular, policy or systemwide projections typically involve far greater uncertainty and consequent imprecision. Typically, one of a number of surrogate sources is employed to estimate the relevant information, such as claims data or even expert opinion. When several such estimates of uncertain accuracy are employed together, the result may be little more than an elegant “back of the envelope” projection.

Medical Cost Drivers

Cost drivers can be considered conceptually to fall into four major categories (Table 42.3): patient-related factors, treatment-related factors, provider-related factors, geographic-economic factors (1). Patient-related factors affect cost primarily by influencing the likelihood of complications of various types and severity resulting from variations in the severity in the underlying disease process and the extent of comorbidity. Treatment-related cost determinants fall into two major categories. The first involves costs incident to management decisions made by the medical providers. Thus, an aggressive interventional management strategy for a patient with an acute coronary syndrome (ACS) will be associated with higher medical costs (over the short run at least) than a conservative strategy. Second, there is a more complex interaction between the management strategy selected and the patient characteristics, which may result in an increase or decrease in treatment-related complications and consequent cost. For example, timely aggressive intervention may prevent a serious complication that would have otherwise resulted from disease progression. Alternatively, use of an aggressive strategy may cause a previously unsuspected comorbidity to become clinically manifest and thus induce extra medical care costs.

TABLE 42.3 Major Categories of Medical Cost Drivers | ||||

|---|---|---|---|---|

|

Provider-related factors refer to quality and efficiency of care issues as well as overall preferred management styles for a particular clinical problem. Complications associated with medical care cannot be eliminated, but care that is of a very high technical quality can minimize those complications relative to care of lesser quality. Efficiency of care as it relates to a provider refers to the provision of the required care with a minimum set of necessary medical resources and thus the minimum amount of waste achievable. Multiple studies have now shown that some practitioners have a more resource-intensive style of practice than others; how these different styles related to quality and efficiency of care remains controversial (22,23,24,25,26,27).

Even after all the foregoing characteristics are accounted for, costs will still vary from one provider to the next because of geographic-economic factors that create true variations in the costs of the component resources required to provide the care in question. Variations in the cost of medical care labor in different geographic markets and variations in the purchase price of supplies can both affect cost in important ways. For example, low unemployment rates and a shortage of skilled registered nurses may drive up the salary rate for nurses in a particular region. Very large hospital chains or payers can negotiate discounts with medical suppliers and pharmaceutical companies that are not available to small independent providers.

Cost-Effectiveness Analysis

Cost-effectiveness analysis is a form of economic efficiency analysis (1,11,28,29). As described earlier in this chapter, economists are concerned with making decisions about the most efficient use of scarce societal resources. The principal agenda of the analysis is to define for the policy maker how to allocate finite health care dollars among the possible alternative programs. In its most general form, economic efficiency analysis attempts to help solve problems of allocation of resources across major sectors of the economy, such as education,

defense, public works, and health care. It is assumed in such analyses that the decision maker desires to maximize the benefits produced for society for a given investment of resources. Consequently, these techniques are insensitive to considerations about who gains and who loses as such trade-offs are made.

defense, public works, and health care. It is assumed in such analyses that the decision maker desires to maximize the benefits produced for society for a given investment of resources. Consequently, these techniques are insensitive to considerations about who gains and who loses as such trade-offs are made.

Types of Analyses

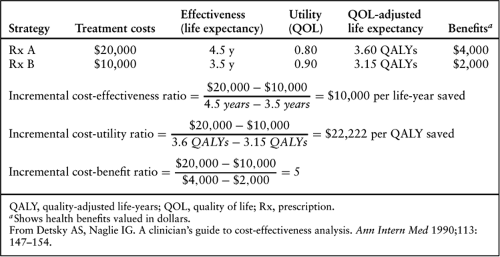

Economic efficiency analysis actually includes three related analytic techniques: cost-effectiveness analysis, cost-utility analysis, and cost-benefit analysis (Table 42.4) (30). These methods have several important features in common. First, all three explicitly evaluate the following decision maker’s dilemma: “In moving from a reference therapy (strategy) to a new therapy (strategy), how much will be gained in additional benefits, how much additional cost will be incurred, and will the resource (monetary) investment required to produce an extra unit of benefit with this new therapy fall into an acceptable or worthwhile range judged according to past experience or other precedents?” The general formula for all three techniques is as follow:

Where C = costs and E = effectiveness.

Second, they all use the same calculation for the incremental costs of the new strategy or therapy (Table 42.4).

The three modes of economic efficiency analysis differ in the way they evaluate incremental health benefits (Table 42.4) (30). Cost-effectiveness analysis expresses incremental benefits in terms of natural units. Most commonly, incremental life-years are used. It is this form of the cost-effectiveness ratio for which most of the available benchmarks exist (Table 42.5). However, it is legitimate to calculate cost-effectiveness ratios using other medical end points. For example, a cost-effectiveness ratio of incremental dollars required to save an additional life or to produce an additional 30-day survivor or to discover one additional patient with left main coronary artery disease (CAD) could be calculated if such outcomes were deemed relevant to decision making. The difficulty is not in calculating such ratios, but rather in interpreting them. There is a general consensus that cost-effectiveness ratios less than $50,000 per added life-year are “economically attractive,” whereas ratios above $100,000 per added life-year are “economically unattractive” (1,11). The middle zone represents an uncertain area. No such benchmarks exist for cost-effectiveness ratios constructed with other effectiveness measures such as those cited earlier. Thus,

these alternative cost-effectiveness ratios cannot be used for making broad-based trade-offs among alternatives for societal investment, and they can be problematic to interpret as isolated measures of value within a given health care system.

these alternative cost-effectiveness ratios cannot be used for making broad-based trade-offs among alternatives for societal investment, and they can be problematic to interpret as isolated measures of value within a given health care system.

TABLE 42.5 Cost-Effectiveness and Use of Selected Interventions in the Medicare Populationa | ||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| ||||||||||||||||||||||||||||||||||

Cost-effectiveness ratios are not the precise figures they appear to be (31). Rather, they are estimates with varying (often large) degrees of uncertainty incorporated in their calculation. Furthermore, no single cost-effectiveness threshold separates the “worthwhile” from the “worthless” interventions. The figures discussed in the previous paragraph for dollars per added life-year are general guidelines, not absolute benchmarks. A cost-effectiveness analysis addresses a particular decision scenario for a particular time. Its results are not absolute for all scenarios at all times. A particular intervention may be judged economically attractive in the United States but not in the United Kingdom. Similar disparities may arise in the fee-for-service versus managed care segments of the U.S. health care system. These differences relate in part to variations in the costs of care in these different systems as well as to the different levels of willingness to spend additional dollars to buy more health care benefits.

Cost-utility analysis is a special case of cost-effectiveness analysis in which the benefit is expressed most often as a quality-adjusted life-year (QALY) (Table 42.4) (30). Calculation of such a quantity assumes that patients would be willing to give up extra survival to improve quality of life. The process of equating various quality of life states to equivalent survival durations is known as utility assessment. Utilities or utility weights are quantitative measures of the relative desirability of different health states. By convention, they are scored from 0 (death) to 1 (excellent health), although values less than 0 can be used to represent health states judged worse than death. Although this system is conceptually attractive, it has some important pragmatic problems in assessing utilities and incorporating them into an economic analysis. The two major methods of deriving utilities for use in economic analysis are direct assessment and use of a health utility index. Direct assessment typically involves interview- or questionnaire-based measurements using patients in a given health state of interest or, less commonly, other subjects who are asked to imagine (with the help of certain descriptive aids) being in the health state in question. The most commonly used direct assessment methods are the standard gamble and the time trade-off (11,32). The major alternatives to these direct utility assessment techniques are the health utility indexes. Each index consists of a set of discrete health states, typically defined in relatively simple generic terms, for which utility weights have been derived. Most often, utility weights are obtained from the general (nondiseased) population. The most widely used health utility index at present is the EuroQoL 5D (11,33).

Cost-benefit analysis requires that health benefits be converted to their monetary equivalent (Table 42.4) (30). Because physicians and patients are often uncomfortable with these conversions, and because the methodology for making such equations is vulnerable to important technical and ethical criticisms, this method of analysis is infrequently used in medicine. Its principal advantage over the other forms of economic analysis is that it can be used across the entire spectrum of societal decision making, whereas cost-effectiveness and cost-utility analyses are useful only for health policy decisions in which the goal is to maximize the added life-years (or added QALYs) produced. Cost-benefit analysis directly calculates the gain or loss for society of a particular program expressed in terms of dollars invested versus the monetary value of the return on investment. The results can be expressed as a ratio (as shown in Table 42.4) or (more preferably) as the net benefits of the program (the incremental benefits minus the incremental costs). If the cost-benefit ratio is greater than 1, or the net benefits are positive, the program is judged “worthwhile” from a societal perspective.

Several groups have proposed standards for cost-effectiveness analysis (11,34,35,36). The Panel on Cost Effectiveness in Health and Medicine convened by the U.S. Public Health Service published the most widely cited expert consensus standards for U.S. cost-effectiveness analysis (11,37,38,39). The special challenges of performing economic analyses alongside multicountry randomized clinical trials has received increased attention recently because of the rising proportions of all large trials that are now international (40).

Economic Studies of Cardiovascular Disease

Acute Coronary Syndromes

General Considerations

ACSs (acute myocardial infarction (MI), unstable angina) share a common pathophysiology, similar clinical manifestations, a need for hospital-based management in most cases, and a self-limited course that extends typically 30 to 60 days from presentation (41,42). After this period, most (surviving) patients cycle back to a more stable phase of CAD. The economic analysis of ACSs and their treatments therefore is primarily focused on the events during the critical initial phase of presentation and care, particularly those occurring during the initial hospitalization.

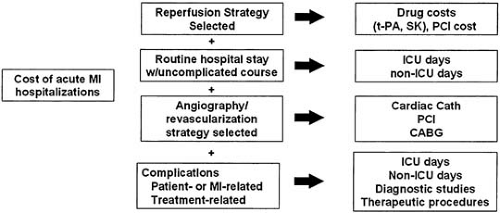

Conceptually, hospitalization for an ACS can be divided into four major resource/cost components (Fig. 42.1). In patients eligible for reperfusion therapy, the reperfusion strategy selected (i.e., either thrombolytic therapy or primary coronary angioplasty) is a major cost component. Although streptokinase (SK) is relatively inexpensive (at around $300 per dose), tissue-type plasminogen activator (t-PA), recombinant t-PA (rt-PA), and tenecteplase (TNK) all cost more than $2,000 per dose, and the

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree