61 Medical Economics in Interventional Cardiology

According to recent American Heart Association (AHA) estimates, percutaneous coronary intervention (PCI) is performed in the United States about 1.18 million times each year.1 Despite this astonishing level of its adoption into mainstream cardiovascular practice, controversies persist about the appropriate indications for PCI and about its value provided for money spent in different clinical contexts. The purpose of this chapter is to review what is known about this question of value for money. Rather than striving to be encyclopedic, this chapter will emphasize broad concepts and selected studies that best illustrate these concepts in different areas of interventional cardiology. The first part of the chapter provides an overview of important economic concepts and approaches. The second part reviews empirical research data on the economics of interventional cardiology.

Medical Economics: Concepts and Methods

Medical Economics: Concepts and Methods

Medical Cost Definitions and Terminology

To an economist, a “cost” is not the amount of money required to purchase a particular health care good or service but rather the consumption of societal resources required to produce that good or service, and deliver it to the consumer that could have been used for another purpose.2 The term “opportunity cost” is used in the economics literature to indicate this particular meaning of cost. Society consumes resources to satisfy its wants, including those for food, housing, and recreation, as well as health care. However, because resources are ultimately finite, society cannot satisfy all wants and is obliged to choose from among the potential alternative uses of its resources. Economics provides a set of tools and approaches to assist with the decisions regarding what health care to produce, in what quantity, and for whom. The classic illustration of the constrained resources concept is the “guns-versus-butter” example from freshman economics. Resources expended in the production of weapons cannot also be applied to the production of food; therefore, in a world of limited resources, more weapons may mean less food. At the societal level, more health care may ultimately translate into less investment in education, transportation, housing, or other societal priorities.

Opportunity cost is a foundational concept but not a measurement tool. In most actual economic studies, accounting costs are measured as a surrogate for opportunity cost, in large part because the former are easier to measure. Accounting costs are the monetary prices we are more familiar with when we think about the concept of cost. In most businesses or industries, the market price of a product or service is equal to the cost of producing that item plus some amount of profit (typically reflecting a fair return on investment). In the U.S. medical sector, the discrepancy almost universally observed between prices (or charges) and costs (the true accounting cost of providing a given medical service) is largely attributable to “cost shifting,” a set of accounting practices designed to shift costs from a variety of sources (Table 61-1) onto whichever group of payers is most willing and able to absorb them. The net effect of these cost-shifting practices is to distort the relationship between U.S. medical prices or charges and medical resource consumption. U.S. medical charges are, for that reason, never a good surrogate for medical costs, and their use in research and policy evaluations should be avoided.

TABLE 61-1 Major Components of Hospital Charges for Medical Services

1. True costs to hospital of resources consumed (e.g., disposable supplies, personnel equipment allocated overhead) |

1, cost for given hospital service; 1–5, Charge or price for given hospital service.

From Mark DB, Jollis J. Economic aspects of therapy for acute myocardial infarction. In: Bates ER, ed. Adjunctive Therapy for Acute Myocardial Infarction. New York: Marcel Dekker, Inc., 1991:471–496, with permission.

Methodologic Issues in Medical Cost Studies

To perform a medical cost study, it is necessary to consider five major issues (Table 61-2): (1) the way cost is to be conceptualized and measured, (2) the type of study to be performed (the structural framework in which the cost analysis will be accomplished), (3) the perspectives of the analysis, (4) the importance of cost variations over time, and (5) the importance of cost variations caused by geographic and market factors.

TABLE 61-2 Major Methodologic Issues in Medical Cost Studies

| Measurement of cost: |

Categories of cost items to be included: • Department overhead (e.g., departmental administration, maintenance, equipment depreciation, utilities) |

Cost Measurement

In any clinical cost study, the investigators must decide at an early stage what categories of cost items they need to include in the analysis and at what level of detail they wish to focus (see Table 61-2). In practice, the types of detailed data required for marginal or incremental cost analysis are difficult to obtain unless the hospital or health system involved has a computerized cost-accounting system, and they are impractical (if not impossible) to obtain for all participants in the typical large cardiovascular multi-center trial. Therefore, rather than adding up the individual resources being consumed (which might be termed the bottom-up approach), most U.S. cost studies start with an aggregated measure of costs, such as can be obtained from hospital or physician bills (a top-down analysis). Although the top-down approach is much more practical for many cost studies, especially multi-center studies, it does reduce the ability of the investigator to control the factors that are included as costs in the analysis.

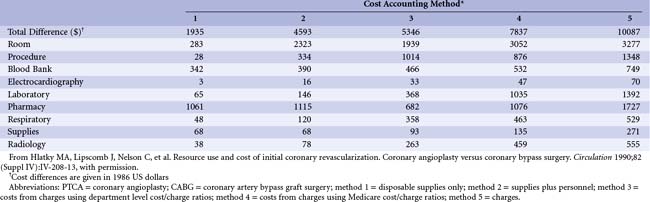

In an older, but still instructive, study examining the practical impact of using top-down versus bottom-up cost estimates, Hlatky and colleagues at Duke compared the magnitude of cost savings available by shifting from a more expensive treatment (i.e., coronary artery bypass grafting [CABG]) to a less expensive one (i.e., percutaneous transluminal coronary angioplasty [PTCA]) in 389 patients with coronary artery disease (CAD). Two bottom-up and three top-down cost estimates were examined (Table 61-3). Using only hospital charges (method 5), the cost savings was estimated at $10,000 per patient shifted to PTCA. However, if no hospital or departmental overhead were to be saved from this change in practice, then the true cost savings would be that estimated by method 1 or 2: 20% to 46% of the amount estimated from charges. Methods 3 and 4, which include varying amounts of overhead, overestimate the short-term cost savings from the CABG to PTCA shift; they are more correctly viewed as providing an estimate of the difference in average cost. Conversely, methods 1 and 2 indicate the marginal or incremental difference. Note that the difference between costs using the Medicare correction factors (method 4) and using charges (method 5) is attributed, at least in part, to the hospital’s shifting of costs from nonpaying patients to the paying segment. This “surtax” would, of course, never be recoverable by changes in patient management. For this reason alone, charges represent a poor choice for evaluating the cost implications of different clinical strategies.

is simple and inexpensive to use (hence its appeal in clinical research), but it suffers from some important drawbacks. First, the source of cost weights is often external to the resource data being analyzed and, therefore, of uncertain relevance. Such cost weights are often chosen because they are conveniently available (e.g., published in some unrelated economic study) rather than because they are well suited to the problem at hand. Second, the appropriate set of big-ticket items necessary to estimate costs accurately using this method has never been rigorously defined. For example, days in the intensive care unit (ICU) is an important driver of hospital costs but is difficult to collect accurately in a multi-center study and may be omitted in favor of total length of stay. How much inaccuracy such a decision introduces into the costing and its effects on estimates of incremental costs are important, but often ignored, questions. Third, to preserve the desired simplicity, the method usually treats the big-ticket inputs as though they were homogeneous. For example, an uncomplicated single-vessel PCI would typically be assigned the same price as a complex three-vessel PCI procedure complicated by abrupt closure. The true costs of these two procedures may, in fact, differ substantially.

Because of these distortions, the Medicare Fee Schedule—based on the resource-based relative-value scale (RBRVS) of Hsiao and colleagues—has been adopted as a more appropriate method for assigning costs to physician services.3 The basic concept of the RBRVS is that the price of a service should reflect the (long-term) cost of providing that service. Medicare fees are tied to the American Medical Association Physician’s Current Procedural Terminology (CPT) classification system; therefore, to estimate physician costs from these fees, some map must be created between the CPT codes and the data available in the study database about physician services.

Cost Study Structures

Importance of Perspective in Cost Analysis

Cost is always defined (either explicitly or implicitly) in terms of specific buyers and sellers (or consumers and producers). Table 61-2 lists the different perspectives that can be used for a medical cost analysis. Most commonly, economists and health policy analysts advocate the use of a societal perspective, in which total health expenditures (public and private) are examined as a function of the benefits produced and the opportunities forgone across the economy. Such an analysis ideally includes hospital costs, physician fees, outpatient testing, outpatient drug therapy costs, nonmedical direct expenses (e.g., transportation to the medical facility, child care, housekeeping), and the economic impact of lost productivity because of illness.

Time Effects in Cost Analysis

Time effects are important to medical cost analyses for two major reasons (see Table 61-2). First, inflationary forces in the economy cause the value of money to diminish over time, so cost studies from different years should not be directly compared until differences caused solely by inflation are accounted for. Although there are several ways to make this adjustment (none of them ideal), perhaps the most widely used is the medical care component of the Producer Price Index (available at http://www.bls.gov/ppi/).

Geographic and Market Factors

Geographic and market economic factors also have important effects on medical care costs, although these have received little attention in empirical medical cost research. Different practice settings (e.g., within a particular region of the country) can affect the cost of providing a given type of care owing to variations in case mix, different practice patterns of the health care team (e.g., physicians, nurses, administrators), and different levels of efficiency within each setting. For example, for a given patient, care in an academic tertiary care center and care in a large private community hospital in the same city may be associated with quite different hospital costs. First, the teaching hospital must add at least part of the cost of its resident staff, and because an attending physician must supervise the residents, total physician time is usually increased per unit of care in a teaching hospital. Furthermore, residents typically order more tests per patient encounter. Other cost differences could arise from differing levels of nursing intensity at each stage in the hospitalization, differing use of intensive and intermediate care beds, and different typical lengths of stay for particular problems. In the second Thrombosis in Myocardial Infarction (TIMI II) trial, tertiary centers used more coronary angiography, coronary angioplasty, and CABG for initially admitted, medically equivalent patients compared with community hospitals.4

Cost-Effectiveness Analysis

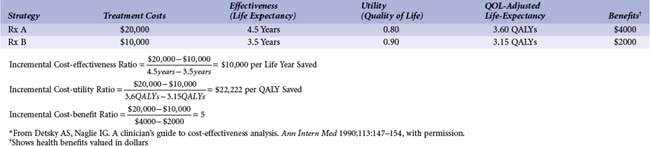

The general term cost-effectiveness analysis actually refers to a family of methods for economic analysis (Table 61-4). For all methods, the final measure is expressed in ratio form, with incremental costs in the numerator and incremental health care benefits or outcomes in the denominator. The distinction among the methods derives primarily from how health benefits are measured. In cost-effectiveness analysis, the measure of incremental health effects chosen is typically the difference in life expectancy between the alternative strategies being evaluated (see Table 61-4). This is the most common type of economic health care analysis performed.

Cost-benefit analysis is used much less often in medicine, probably because it requires measuring all health-related benefits of a program in monetary terms (see Table 61-4). The results of a cost–benefit analysis can either be expressed as a ratio of incremental monetary benefits to monetary costs or as a difference between the two. If the benefit: cost ratio exceeds 1 or the difference of benefits minus costs is positive, the assumed interpretation is that the treatment or program is worth doing, as it provides a net gain to the decision makers. Cost-benefit analysis has the useful feature of permitting comparison of medical care expenditures with societal expenditures on education, defense, transportation, and so forth, whereas cost-effectiveness analysis is useful only in comparison of expenditures that produce the same type of outcome (e.g., QALYs). However, the difficulty of valuing health benefits in dollars in a valid and acceptable way has made this the least used method of efficiency analysis in medical economics.

Table 61-4 compares two hypothetical treatment strategies (A and B) for a particular disease and summarizes the calculations involved in the different analyses. Treatment A costs twice as much as treatment B but also improves average life expectancy by 1 year. Thus, the cost-effectiveness ratio for A relative to B is $10,000 per life-year saved. Whether switching from B to A is “worthwhile” depends on the alternative health care expenditures (aside from A) available for $10,000 or less. This is the most common sort of problem faced in cost-effectiveness analysis: whether to fund a new program that provides more health benefits than the standard therapy but at a substantially increased cost. (It is theoretically possible to go in the other direction—to give up health benefits to save substantial health care dollars—but this is rarely politically viable.)

QALYs allow us to factor in the value (to the decision maker, which may be the patient but could be someone else) of the extended survival offered by a new program or alternative therapy, as well as its quantity. In the example in Table 61-4, strategy A improves life expectancy relative to B, but the average quality of life for survivors is lower. This could come about in several ways. For example, with strategy B the sickest patients could die, leaving a relatively healthier group of survivors. In contrast, strategy A saves these sick patients from dying but cannot restore them to the same level of health as in the case of other patients with lower disease severity. These sicker surviving patients lower the average quality of life for the group. Alternatively, there could be something about strategy A that negatively affects quality of life, such as the need for chronic medication that is associated with significant side effects and that is not required with strategy B. In this example, moving from cost-effectiveness to cost-utility analysis more than doubles the cost of an additional unit of (quality-adjusted) survival with strategy A.

Economics of Interventional Cardiology

Economics of Interventional Cardiology

General Issues

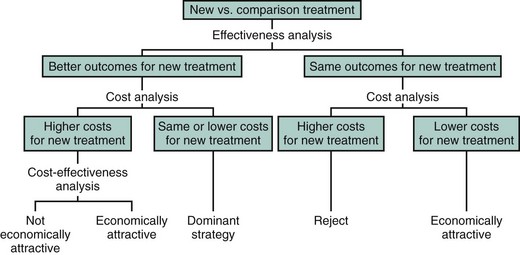

In general, three major patterns of cost outcomes are possible when comparing alternative medical strategies or technologies (Fig. 61-1).

Coronary Revascularization

In 2007, approximately 1.06 million diagnostic cardiac catheterizations, 1.18 million PCIs, and 408,000 CABGs were performed in the United States.1 Because a hospitalization for PCI averages from $8000 to $15,000 and a hospitalization for CABG averages $30,000 or more, coronary revascularization costs in aggregate probably exceed $25 billion per year (Table 61-5). Although the procedures may be more efficient now than in the past owing to shortened hospital stays and lower complication rates, use in patients with more complex disease and advances in technology, especially for PCI, have tended to push costs back up. In this portion of the chapter, we review the available data addressing two key questions: First, what information do we have about how much these procedures cost? Second, what is the value of these procedures, where value

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree