We sought to examine the relation between the United States economic decrease in 2008 and cardiovascular events as measured by local acute myocardial infarction (AMI) rates. Mental stress and traumatic events have been shown to be associated with increased risk of MI in patients with ischemic heart disease. This was an observational study of data from the Duke Databank for Cardiovascular Disease and includes patients undergoing angiography for evaluation of ischemic heart disease from January 2006 to July 2009. Patients with AMI occurring within 3 days before catheterization were used to calculate AMI rates. Stock market values were examined to determine the period of severe economic decrease, and time trends in AMI rates were examined over the same period. Time series models were used to assess the relation between United States stock market National Association of Securities Dealers Automated Quotation (NASDAQ) and rates of AMI. Of 11,590 patients included in the study cohort, 2,465 patients had an AMI during this period. Time series analysis showed a significant increase in AMI rates during a period of stock market decrease from October 2008 to April 2009 (p = 0.003), which remained statistically significant when adjusted for seasons (p = 0.02). In conclusion, unadjusted and adjusted analyses of patients in the Duke Databank for Cardiovascular Disease indicated a significant correlation between a period of stock market decrease and increased AMI rates in our local cohort.

The United States (US) economy had a severe recession in late 2008 that continued into 2009, and with the continued economic decrease, US stocks reached their lowest levels since the 1930s. Although the stock market indexes may be an inconsistent measurement of the overall health of the US economy, they reflect investors’ and public feelings or perception of the state of the economy. In the first analysis of its kind, we sought to determine whether the recent US stock market decrease corresponded to cardiovascular event rates in a cohort of patients undergoing angiography for evaluation of coronary heart disease, as measured by local acute myocardial infarction (AMI) rates, in a single-site observational study.

Methods

Several hypotheses were tested in our study. First, we proposed that during a period of stock market decrease (September 2008 to March 2009), AMI event rates would increase. Second, we proposed that National Association of Securities Dealers Automated Quotation (NASDAQ) returns and AMI events have an inverse relation, regardless of periods of volatility, over the entire 3-year period (January 2006 to July 2009). Third, we aimed to determine if seasonal differences in AMI event rates exists in our local database.

This was an observational study of prospectively collected data from the Duke Databank for Cardiovascular Disease (DDCD). The DDCD is a database that comprises demographic, clinical, and long-term follow-up information on approximately 174,699 cardiac catheterizations from 1969 to the present.

The study cohort consisted of a subset of 11,590 cardiac catheterizations from January 2006 to July 2009 at Duke University Medical Center for evaluation of ischemic heart disease. Rates for AMI were based on the number of AMIs within 3 days before the procedure compared to the total number of angiographies. Multiple AMIs recorded during a 3-day period were counted as a single event. MI was identified using the American College of Cardiology/American Heart Association/ESC/WHF universal definition, including evidence of ischemia with clinical signs or symptoms and/or diagnostic electrocardiographic changes and cardiac biomarker increases. Patients with sudden cardiac death and postprocedure AMIs were not included in our analysis.

Categorical variables were described as percentages, and continuous variables were summarized as medians with interquartile ranges. Differences in binary variables were calculated using Pearson chi-square test. Continuous and ordinal variables were compared using Wilcoxon rank-sum test.

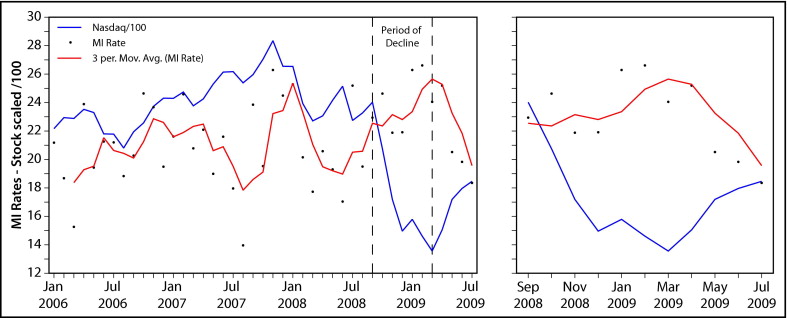

The NASDAQ monthly opening values were examined to determine trends over time and to identify the dates associated with the recent steep decrease. AMIs were grouped into monthly intervals and the monthly rate was plotted over the study period. These numbers were overlaid on a scaled plot of NASDAQ values (NASDAQ values divided by 100), presenting a reasonable visual representation of the data during the same period.

To examine the relation between monthly AMI rates and stock market, time series models were generated to allow for the correlated nature of the data. The primary study question was addressed by fitting an indicator for the period of steep stock market decrease (the “decrease” variable) from September 2008 to March 2009. Because a relation between the NASDAQ and monthly AMIs may not be immediate, we examined whether a period of 1-month lag (October 2008 to April 2009) corresponded with increased AMI event rates. For the secondary question, we used monthly NASDAQ returns to quantify stock market values. Because it has been established that seasonal changes may affect cardiovascular event rates, we repeated these analyses adjusting for seasons.

AMI rates were assessed for violation of the stationary assumption using the Dickey-Fuller test. Partial autocorrelation and autocorrelation functions for AMI rates and residuals were examined to address potential correlation.

We conducted a post hoc sensitivity analysis accounting for the trend in AMI rates over time in our cohort. Statistical analyses were performed using SAS 8.2 and 9.1 (SAS Institute, Cary, North Carolina). The study was approved by the Duke University institutional review board, with a waiver of the requirement for written informed consent.

Results

From January 2006 to July 2009, 17,084 cardiac catheterizations were identified in the DDCD. In addition, 4,909 patients were excluded due to a nonischemic indication for catheterization. Of the 12,175 cardiac catheterizations performed to evaluate suspected ischemic heart disease, 585 multiple catheterizations were excluded within a 3-day period to ensure that multiple AMIs in this window of time were counted as only 1 event (initial catheterization was included as a single event). Of patients used to generate study results, 21.3% had AMIs (2,465 of 11,590). Figure 1 depicts the cohort selection process for inclusion in this analysis. Distributions of baseline characteristics are presented in Table 1 .

| Characteristic | No AMI (n = 9,125) | AMI (n = 2,465) | Total (n = 11,590) | p Value |

|---|---|---|---|---|

| Age (years) | 63 (54–71) | 61 (52–71) | 62 (54–71) | <0.001 |

| Men | 62% | 65% | 63% | 0.006 |

| <0.001 | ||||

| Caucasian | 72% | 67% | 71% | |

| African-American | 23% | 27% | 24% | |

| Native American | 2% | 4% | 3% | |

| Other | 2% | 2% | 2% | |

| Hypertension | 75% | 64% | 72% | <0.001 |

| Diabetes mellitus | 33% | 27% | 32% | <0.001 |

| Chronic heart failure | 30% | 16% | 27% | <0.001 |

| Left ventricular ejection fraction | 61% (53–67) | 53% (43–62) | 60% (50–66) | <0.001 |

| Cerebrovascular disease | 11% | 8% | 10% | <0.001 |

| Peripheral vascular disease | 10% | 9% | 10% | 0.068 |

| Smokers | 46% | 42% | 45% | 0.003 |

| History of hyperlipidemia | 67% | 51% | 63% | <0.001 |

| Body mass index (kg/m 2 ) | 29.0 (25.4–33.4) | 28.1 (25.0–32.2) | 28.7 (25.3–33.2) | <0.001 |

Graphic trend plots suggested that the rate of AMIs had increased from July 2008 to January 2009 when the NASDAQ decreased and decreased from January 2009 to July 2009 when the NASDAQ was recovering ( Figure 2 ). In the time series model, during a period directly associated with the stock market decrease from September 2008 to March 2009, AMI rates were significantly higher (p = 0.01). There was also a strong relation between the period of stock market decrease and increased AMI rates using a 1-month lag period from October 2008 to April 2009 (p = 0.003; Table 2 ). Comprehensive time series analysis showed no statistically significant correlation between stock market returns and AMI event rates over a 3-year period not taking into account periods of volatility (January 2006 to July 2009, p = 0.62; Table 2 ).

| Point Estimate | 95% CI | p Value | |

|---|---|---|---|

| Monthly myocardial infarction rates and period of decrease in stocks | |||

| Decrease from September 2008 to March 2009 | |||

| Unadjusted | 3.2 | 0.1–6.2 | 0.01 |

| Adjusted for seasonality ⁎ | 2.0 | −0.3 to 4.3 | 0.10 |

| Decrease from October 2008 to April 2009 | |||

| Unadjusted | 3.5 | 1.3–5.7 | 0.003 |

| Adjusted for seasonality † | 2.7 | 0.6–4.9 | 0.02 |

| Monthly myocardial infarction rates and NASDAQ returns without “decrease” variable ‡ | |||

| Monthly returns | |||

| Unadjusted | −0.4 | −1.8 to 1.1 | 0.62 |

| Adjusted for seasonality § | −0.1 | −1.5 to 1.3 | 0.88 |

⁎ p = 0.14 for spring; p = 0.03 for summer; p = 0.86 for decrease (model has 4 degrees of freedom).

† p = 0.10 for spring; p = 0.03 for summer; p = 0.69 for decrease (model has 4 degrees of freedom).

‡ A binary variable (decrease) corresponding to the 7-month period of sharp decrease is used as the covariate of interest represented in the table (0 = not during this period; 1 = during this period).

§ p = 0.08 for spring; p <0.01 for summer; p = 0.88 for decrease (model has 4 degrees of freedom).

Stay updated, free articles. Join our Telegram channel

Full access? Get Clinical Tree